Why Market Timing Doesn’t Help

That missing the two bear markets in 2000-2002 and 2007-2008 does not matter even if you are forewarned in January 1998.

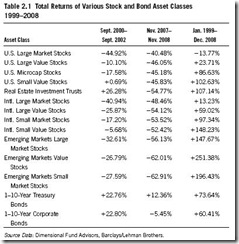

The graph from his book with data from Dimensional Fund Advisors gives this illuminating message.

If you had invested in anything other than the U.S. large market stocks in January 1998, you would have made money despite the two bear markets.

I don’t have the latest figures, but I would have guess that the figures are even better as market has climbed in the tail end of 2009 and start of 2010.

What does it mean for us investors?

That it is more important to stay in the market even when the market lurched and go down by more than 60%. As it is aptly shown in the table in column 2 where you see the emerging market shares going down to 62%.

By end of Dec 2008 (even though the bear market will eventually run to March of 2009) it is up +251%.

Even if you knew that the market will go down in two major bear market, and stayed out since January 1998, the scared away investor will have missed the returns that a portfolio of the different investments would have brought.

When you stay invested, you will be participating in the run up. If you sell and stay away, you will be constantly thinking of when you can go back into the market.

Another lesson from the table is the importance of real diversification. If all you have is large stocks, your portfolio will be hammered and show a negative 13.77%. True diversification goes across different asset classes and different categories of stocks.

For me, I stayed invested and kept buying, but it was a hairy ride. I didn’t even feel like blogging on some days as i was wondering why should people be listening to you if your stock portfolio is down at that time? However, I was still buying when it went down and again as it rose.

What about you, how did you last the last big bear?

Source:

1. The Dimensional Fund Advisors

2. Excerpt of “The Investor Manifesto”

Related Posts

Disclaimer

reliance placed on information provided in the blog.

Shares and financial instruments illustrated in this blog can go down sharply or in certain instruments suffer total loss on the initial investments. Investors are advised to make their own judgment on the information provided and consult their own financial advisors or consultants as to the suitability of the products illustrated to their particular financial needs and objectives before acting on any information contained herein in this blog.

Post a Comment