7 in 10 Don’t Have Enough for Retirement

In the papers today, it claims that investors are more upbeat. However, it says in the same article that 7 in 10 feel that they don’t have enough in their Central Provident Fund (CPF) for retirement.

Guess it means that around 3 out of 10 reading this are interested in planning, saving and investing for retirement.

Are you one of those?

What are you prepared to do to save more or invest more?

I wonder how many of the 7 are doing something to save more to make sure that they have enough to retire on.

Also, it mentioned that 4 in 10 remained invested in the turbulent markets last year while another 4 in 10 who who stopped investing in 2009 either have resumed investing or intend to do so when the opportunity arises. I wonder that the 2 in 10 are doing? I hope that you are not 1 of the 2.

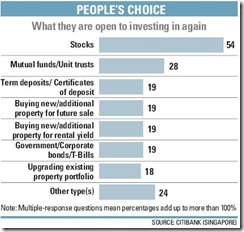

If you are, do not fret, the chart above shows the different ways that you can invest and you can google any of the terms there to find out what they mean.

It is never too late to know and do something about it.

If you are one of my regular blog readers and know about my stock and unit trust positions, it hasn’t changed at all from August 2009 except I bought more unit trusts from dollar cost averaging. The percentage changes have moved up and down some, but it is more up than down ( I think).

I don’t check my stock position when I am working but found myself checking it daily when I was on holidays, go figure. I took loads of photos and I shall be sharing some of those over the next few posts.

This being the first post of 2010, let me wish all the readers a belated Happy New Year. Have a great investing year of 2010.

Related Posts

Disclaimer

reliance placed on information provided in the blog.

Shares and financial instruments illustrated in this blog can go down sharply or in certain instruments suffer total loss on the initial investments. Investors are advised to make their own judgment on the information provided and consult their own financial advisors or consultants as to the suitability of the products illustrated to their particular financial needs and objectives before acting on any information contained herein in this blog.

Post a Comment