Calculations of Savings for Pre-Payment of House Loan

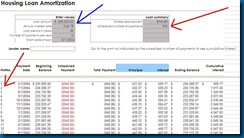

So I have done up a simple excel sheet that shows the monthly payment and the cumulative interest payments.

You can download the excel file here.

All you have to do is to key in the variables in the grey box with the blue arrow.

The grey box with the red arrow will show the monthly payment you have to pay off the housing loan. All you have to do is to note the number of payments you will be making. Say it is 240 payments. Then you look for the 240th payment on the left arrow and scroll down to look for the cumulative interest paid over 240 months and note the figure.

So if you decide to cut down the number of years to pay off the loan, you key in the number of years and look for the cumulative interest. It should be a smaller amount as you would be paying less interest.

The difference between the two figures is the savings you will get if you pay it off earlier.

You should consider if you can use the sum to pay off the housing loan to better use by investing it to get a return higher than the housing loan.

Related Posts

Disclaimer

reliance placed on information provided in the blog.

Shares and financial instruments illustrated in this blog can go down sharply or in certain instruments suffer total loss on the initial investments. Investors are advised to make their own judgment on the information provided and consult their own financial advisors or consultants as to the suitability of the products illustrated to their particular financial needs and objectives before acting on any information contained herein in this blog.

October 14, 2009 at 3:08 PM

Thanks for the table, dude : )

If we pay off a 30-yr loan in say, 20 years:

- are we still liable to pay off principal + 30-yr cumulated interest? Or will HDB re-calcuate?

- the only savings are the additional interest payment, right?

October 14, 2009 at 11:55 PM

If you pay off a 30 year loan in 20 years. HDB will recalculate the loan and your monthly payment will increase according to what is shown in the excel sheet, taking into account what is the total principal still left. Logically, the monthly payment will increase.

Yes, the savings are the interest payments you would have paid if you had stretched and left the loan at 30 years.

I would have liked to present a comparison with what could have happened if you used the additional money to invest at a higher rate instead but my free hosting service is kaput.

Then you can do a comparison and decide for yourself what you want to do.

Should be able to do it over the weekend when it is back up.

Thank you for visiting!

October 15, 2009 at 11:16 AM

I know of friends who took up 30-yr loans as they were only fresh out of school then.

Now that they have worked for a good number of years, what they do is to dump in their year-end bonus to speed up the payment. For eg, every month they pay $900, but at the end of every year, they put another $9000 in.

Your table may come in handy with regards to calculating the respective opportunity costs.

Cheers!

October 15, 2009 at 10:06 PM

Yes. If you leave the $9000 in bank, it is better to pay off the housing loan earlier. But I rather invest it.

I will try to post about the respective opportunity costs of investing versus paying it off early.

Post a Comment