Calculating Your Insurance Payout Yield

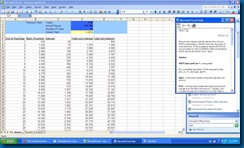

As promised, I have done up a insurance payout yield for you to see how much your insurance policy yields when you got your lump sum at the end.

If you have not retired yet, it will be a good exercise to dig up all your insurance policies and key in the guaranteed sum promised in the policies to see how much it yields at the end.

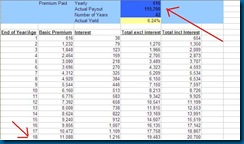

The figure in yellow is the insurance yield which will be generated automatically.

The numbers below show the total payout each year and interest. So you can see if you'd be happy with an earlier payout if your policy allows for it or you may want it to stretch to the maturity date.

Paying around $3,000 each year, I suppose I am one of many people who believe in insurance.

However, if you are young and just join the workforce, I would advise you to get a term insurance and not those endowment policies where the investment yield is much lower than if you had invested in an index fund or exchange trade funds (ETFs). On hindsight, the money could be better invested and yield a higher interest by investing directly in the equity markets.

I am gathering materials to write a post on how to save money. If you have any tips or hints, please give me your comments here or email me at: lemizeraq at gmail.com

With the payout from insurance polices and investment, these are essential steps towards your financial freedom and a comfortable retirement.

Related Posts

Disclaimer

reliance placed on information provided in the blog.

Shares and financial instruments illustrated in this blog can go down sharply or in certain instruments suffer total loss on the initial investments. Investors are advised to make their own judgment on the information provided and consult their own financial advisors or consultants as to the suitability of the products illustrated to their particular financial needs and objectives before acting on any information contained herein in this blog.

Post a Comment