Buying a HDB Flat in Singapore- Part 1 of 3

In Singapore, one of the ways to propose is to say “Give me your IC, I’d go and apply for a flat together.”

That’s likely to get a knock on your head by your significant other. I didn’t propose that way, but I’ve heard that engineers are guilty of that. So what do the engineers out there think?

Choices, Choices and More Choices

Coming back to the HDB flat, once you have decided to buy one, there are myriad options available to you. Do you buy a 3-room, 4-room, 5-room, Executive flat? Just enough for the two of you or the bigger the better?

Cost considerations would be a factor here. The bigger it is, the more expensive. And down the years, you will also be hit by higher taxes, less subsidies, less money given to you for any “Growth Package” that is given by the government.

And we wonder why people don’t have babies. Guess some of the couples who got married bought the cheapest and smallest acceptable flat that they could find.

The sum total of HDB flat that I’ve bought is one. In case you wonder how much of an expert I am.

But before getting the HDB flat, I trough through the HDB website almost religiously, looking at all the different schemes, the regulations, to understand the nuances of what it means to be a flat owner.

Factors to Consider when Buying

What were the things I considered when buying my present flat?

| convenience | proximity to parents | environment |

| neighbours | amenities | public transport |

| cost | size of flat | state of the flat |

| availability of loans | years to pay off loan | sum in CPF OA |

As this is a financial blog, my focus here will be to look at cost, availability of housing loans, years to pay off the loan and sum in CPF OA. Anyway, the others are pretty much self explanatory anyway.

In this housing series, we will look at different items in turn when you want to buy a flat. We shall cover cost in this first part.

Cost of the HDB Flat

To look at this, it is important to understand that to buy or foot the installment payments for buying the flat, your spouse and your salary needs to be able to sustain the payment.

It is foolhardy to buy a humongous flat, stretch it to the max, pay $2000 a month when your combined income is say $3500. That is a recipe for disaster.

In financial websites, a common percentage figures for the housing loan installment that you can afford ranges from 30%-35% of your monthly combined pay.

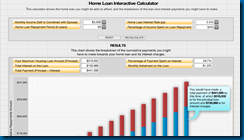

The CPF Website has a nice page, Housing Loan Interactive Calculator, where you can key in all these details to find out exactly how much of a housing loan you can afford.

So for example, if your combined income is $3500, the maximum you are looking for a housing loan installment should be $3500 x 0.35 = $1225.

In this example, this works out to be a housing loan of around $310,000 which you can afford to pay, assuming that you stretch your housing loan to the maximum of 30 years.

You would be paying in total $441,000. With $130,968 as interest, almost 30% as the interest paid to CPF for them lending the money to you as a HDB loan.

In the next part to be covered next week, we will look at why you should stretch your loan to 30 years and still pay this interest. A bit counter-intuitive, but it is an exercise in logical thinking.

Source:

1. HDB Website

2. CPF Website

3. Temasek Review Article, “Mah Bow Tan- Longer Housing Loan Helps People to Pay Less”

Related Posts

Disclaimer

reliance placed on information provided in the blog.

Shares and financial instruments illustrated in this blog can go down sharply or in certain instruments suffer total loss on the initial investments. Investors are advised to make their own judgment on the information provided and consult their own financial advisors or consultants as to the suitability of the products illustrated to their particular financial needs and objectives before acting on any information contained herein in this blog.

Post a Comment