A Defensive Investment Class? The REIT

With the market stumbling today and the Koreans shooting at each other, it is a good time to talk about REIT.

REIT, if you don’t know anything about, is Real Estate Investment Trust. A type of hybrid of stock and property, where essentially you are buying into a stock which holds a portfolio of properties. These properties gets rental yield and could appreciate if the property prices goes up.

So in a sense, it is a proxy to investing into properties without you going to look for houses and apartments to buy. Also, liquidity is higher for REIT as you can sell them on the open stock market easily and quickly just like any ordinary stock while it can take some time and effort to sell a property.

Another benefit is the relatively higher dividend yields that REITs earn compared to most classes of stocks.

Also, it has been touted as a counter cyclical investment class. In simple language, it means that when the market dives, the REIT may move down more slowly or even move up. However, when properties itself is the cause of the financial crisis recently, it moves together with the equity market. So it may not be a perfect counter cyclical investment class.

The flip side is that the upside potential is limited in a REIT, although that is arguable too. In my own portfolio, my sole REIT, the Suntec REIT is my best performing REIT having risen 150%.

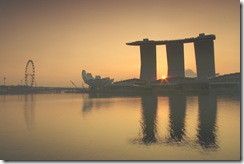

In Singapore, we have 20 REITs ranging from retail, office, industrial, hospitality and residential sectors. If you want to, you can even get REITs of properties based in other countries like Japan, China, India etc.

Today I bought some stocks of Genting during the market correction at the sell price. I am hoping to hold for a while and sell it off to earn a quick profit.

My regular readers will know that I bookmark good sites in Google Reader through the feedburner and I found an interesting site Singapore REITs which focuses on REITS in Singapore. You may want to check out the site for its regular updates on REITS.

Related Posts

Disclaimer

reliance placed on information provided in the blog.

Shares and financial instruments illustrated in this blog can go down sharply or in certain instruments suffer total loss on the initial investments. Investors are advised to make their own judgment on the information provided and consult their own financial advisors or consultants as to the suitability of the products illustrated to their particular financial needs and objectives before acting on any information contained herein in this blog.

November 25, 2010 at 6:54 PM

hi …thanks for the blog post.you blog is very much informative.honestly i don't know aboutREIT.Closed Loop Recycling

Post a Comment