Calculate Your Target Company's Value

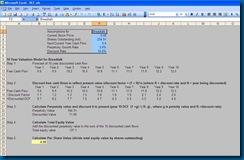

Well, with this excel sheet on the left, you can do your own calculations for the target price that you are aiming for based on the company's current situation and your own analysis of what the potential returns of the company is likely to be.

You can download the excel sheet here to modify it for your own needs and keep one excel sheet for each of the stock you have.

What you do is to enter the figures in the blue area in the excel sheet to key in the figures that you can get from any Bloomberg screens for a company's financial figures. You can get them from the company's annual reports or from online brokerages accounts like POEMS too. The last three figures in the blue area you have to enter in bold are your assumptions based on your own analysis.

This is the methodology for how companies like Morningstar and other stock analyst do their target price.

Basically, they look at the free cash flow generated from a company ( you can see the historical figures of the company that is listed and project a growth to the next 10 years, if the figures fluctuates a lot, you may want to use a low percentage, even below 1%). Then they project this for 10 years, discount it back to the present.

You use a higher discount rate for riskier companies. Studies have found it to be about 10.5% so you can use 9% for relatively stable companies with solid consistent earnings and put it to 12%, 13%, 14% or higher for companies which are risky and have fluctuating earnings.

Going through this exercise will enable you to see more clearly if the stock you are getting is worth it looking at a time range of about 10 years.

If the price indicated (in yellow) is less than the current price, it means that the current price is overvalued and you should proceed with caution.

If however, the price is higher, it indicates that there is likely to be value to be found in the stock and you can consider delving deeper to check.

Don't just blindly accept the analyst's figures, check for yourself and see what sort of assumptions they are making.

Remember it is your own financial independence and freedom that you are striving for.

Related Posts

Disclaimer

reliance placed on information provided in the blog.

Shares and financial instruments illustrated in this blog can go down sharply or in certain instruments suffer total loss on the initial investments. Investors are advised to make their own judgment on the information provided and consult their own financial advisors or consultants as to the suitability of the products illustrated to their particular financial needs and objectives before acting on any information contained herein in this blog.

September 14, 2010 at 3:14 PM

Hi Lemizeraq,

Many thanks for the formula.

Can I assume we use the following as a guide:

Cash Flow Growth Rate = Inflation Rate?

Perpetuity Growth Rate = GDP or the rate of growth of a particular sector?

Post a Comment